Indicator name: ClusterDelta VWAP

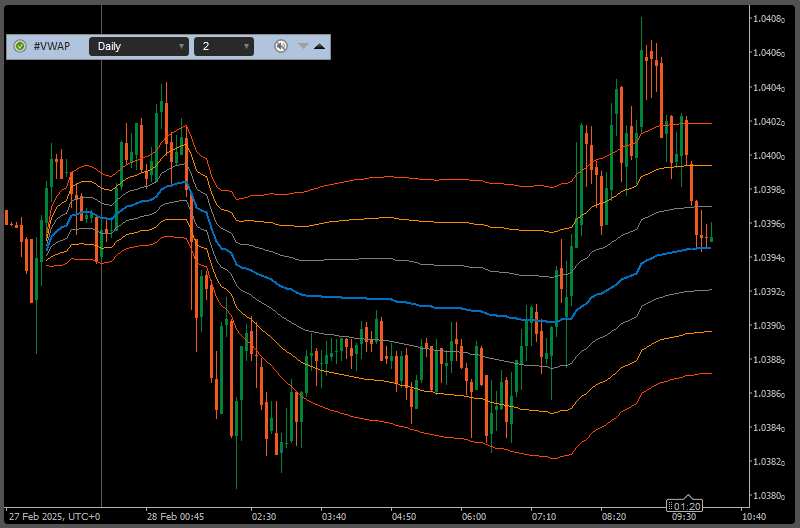

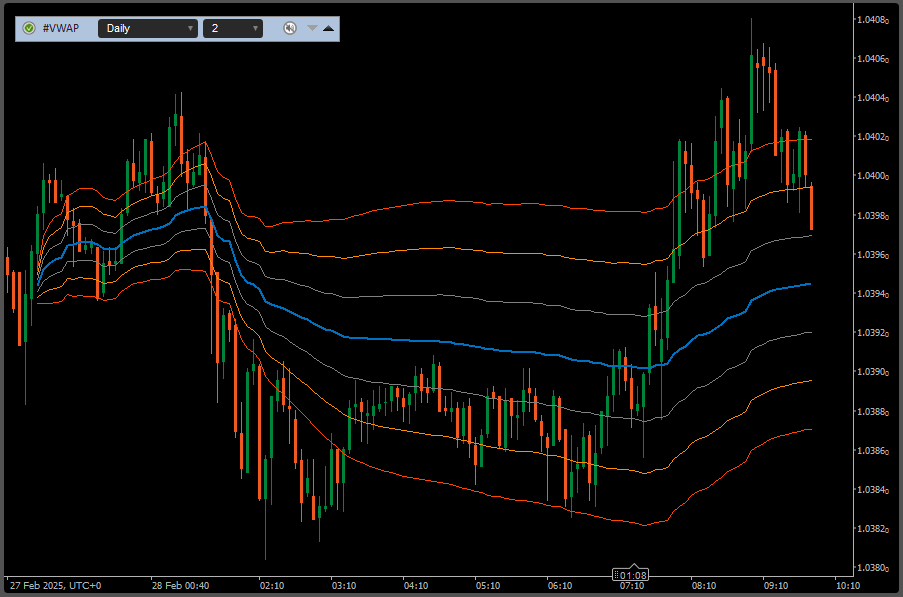

Indicator VWAP - Volume Weighted Average Price (VWAP). In finance, volume-weighted average price (VWAP) is the ratio of the volume traded to the total volume traded over a particular time period (usually one day). It is a measure of the average price a derivative traded at over the trading period.

VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. Many pension funds, and some mutual funds, fall into this category. The aim of using a VWAP trading target is to ensure that the trader executing the order does so in-line with volume on the market. It is sometimes argued that such execution reduces transaction costs by minimizing market impact (the adverse effect of a trader's activities on the price of a security).

WAP can be measured between any two points in time but is displayed as the one corresponding to elapsed time during the trading day by information provider.

VWAP is often used in algorithmic trading. Indeed, a broker may guarantee execution of an order at the VWAP price and have a computer program enter the orders into the market in order to earn the trader's commission and create P&L. This is called a guaranteed VWAP execution. The broker can also trade in a best effort way and answer to the client the realized price. This is called a VWAP target execution; it incurs more dispersion in the answered price compared to the VWAP price for the client but a lower received/paid commission. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms.

DESCRIPTION OF THE VWAP INDICATOR PANEL

The VWAP panel contains the "Authorizer" icon, the indicator name, the number of VWAP periods to load and display, where the value "None" removes VWAP data from the chart, an Alert icon and an icon (arrow up) to close the current VWAP GUI panel. The hot key 'Z' hides this panel, and hot key 'X' shows it again.

The cTrader has some limitations for custom objects, so to move the panel among the window, there is a small trick: click to the indicator name and release the mouse button (the title will change its name to display the data source and the control with the amount of days will hide), move the mouse out of the GUI panel and the panel will follow the mouse cursor, then click again on the indicator name again to turn off the panel moving mode.

To switch between the Alert modes, just click to the Alert Icon

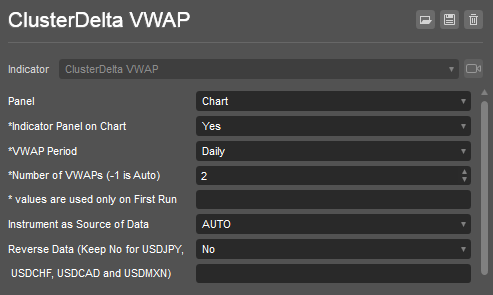

CLUSTERDELTA VWAP INPUTS DESCRIPTION

Common Settings describes the basic parameters of the indicator. The standard behavior of cTrader when changing values of any settings is to immediately reload indicators, which requires remote access to ClusterDelta servers to reload data, so it is highly recommended to change all settings the first time you attach an indicator to a chart. Options starting with '*' (asterisk) cannot be changed after the indicator is attached, as they are part of the GUI panel. Use the GUI panel to change the options allowed there, but in case you need to change options in the cTrader indicator settings panel, it will be easy to remove the indicator and reattach it with new settings changes./p>

Panel is the indicator location. The current indicator works with the "Chart" value only

Indicator Panel on Chart shows or hides the VWAP Panel on start

VWAP Period is the time range (Hour, Day, Week) on which indicator is calculated its values.

Number of VWAPs is an amount of period to load data for the VWAP indicator.

Instrument as Source of Data - select a futures from the dropdown list as the source for data. Value AUTO causes automatic detection of the instrument using the cTrader ticker.

Reverse Data is an option for reverse the VWAP data for reversed currency pairs except those that have name "USDJPY", "USDCAD", "USDCHF", "USDMXN". This option was added for compatibility, but in 99.9% of cTrader cases leave it "No".

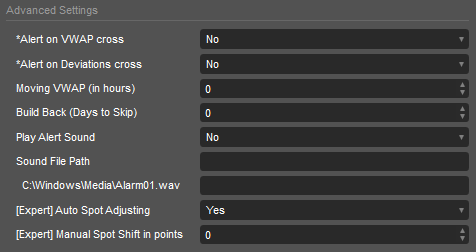

Advanced Settings

Alert on VWAP cross initiates the Alert event when the price crosses the VWAP line.

Alert on Deviations cross initiates the Alert event when the price crosses the deviations lines of the VWAP indicator.

Moving VWAP (in hours) is the option to calculate VWAP ony using the data of the last hours defined by this value. It allows you to cut off the old date that would be outdated for VWAP calculations.

Build Back (Days to Skip) is the option to work with history data. It determines the number of days to skip from the current date and then load the required historical data using the "Days to Load" setting from the Common Settings.

Play Alert Sound is an option for the sound file to be played when an alert event is triggered.

Sound File Path must be an existing path to a sound file to play when an alert event is triggered. It must be filled by user in a format like the field below: "C:\Windows\Media\Alarm01.wav"

[Expert] Auto Spot Adjusting is an option that allows you to adjust DPOC data to the spot chart using the latest highs and lows of the current trading session. The difference that is automatically calculated using this option may vary from trading session to trading session, so this may result in incorrect alignment of DPOC data for different trading sessions.

[Expert] Manual Spot Shift in points sets the manual value to be used to adjust DPOC data to the spot chart. Use the middle mouse button to measure the distance in points to use this value in this option.

Other Settings

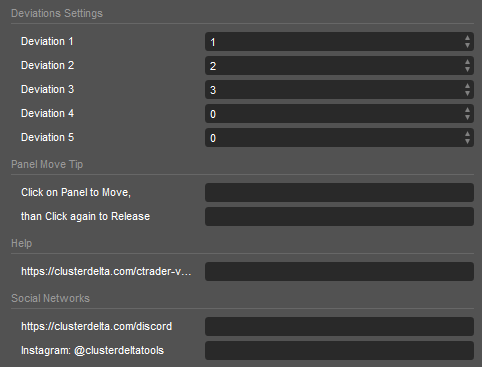

Deviation Settings are the coefficients of the deviations lines from the main VWAP line. The "0" value means that the deviation option is not used.

Panel Move Tip describes the trick on how to move VWAP panel

Help Url section is the URL to get the full documentation about indicator

Social Networks are the links to join our Discord and follow us in the Instagram