Indicator Name: ClusterDelta #Imbalance

The Imbalance indicator is designed to display trade imbalances in the trading process. The most common form of imbalance is a significant ratio between buyers and sellers (Ask:Bid) or the complete absence of one of them.

The Imbalance indicator shows you the zones where the ratio between Ask and Bid values is abnormal. The main option is the Ratio coefficient. When the result of dividing of Ask:Bid or Bid:Ask is more than the Ratio, there's imbalance. There are two types of imbalances. The Ask:Bid Ratio calculates the value and compares it to the Imbalance Ratio when the Zero side is just an imbalance where the left or right part has no volumes (zero value).There are two modes of imbalances. Price Ask=Bid calculates the ratio between Ask and Bid in the same row (on the same price) when Ask>Bid uses for calculations Ask volume above Bid volume.

The imbalance is clearly visible on the cluster chart, but this indicator was created for easy viewing them on the price chart.

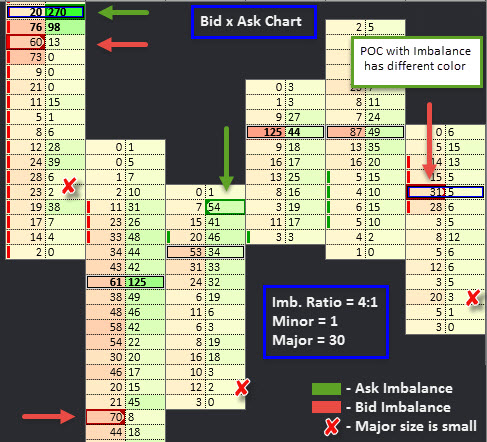

Pay attention to the image below, here is an orderflow chart:

Check the imbalances above: 270:20 = 13 that is greater than current Ratio that is 4 (you can change Imbalance Ratio within range 1.5 - 10), 60:13 >4, 70:8 >4, and so on. 23:2 >4, but 23 is less than Major value (30) so it is not marked as an Imbalance.

The current ClusterDelta #Imbalance also has the option to show Unfinished Auctions where the High/Low of the candle contains Ask and Bid values greater than zero.

DESCRIPTION OF THE IMBALANCE INDICATOR PANEL

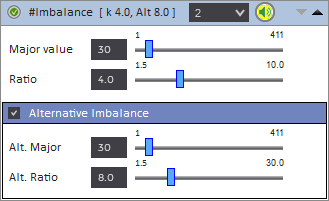

The Title of The Imbalance panel contains the "Authorizer" icon, the indicator name, the number of days to load to load and display, where the value "None" removes Imbalance data from the chart, an Alert icon, an icon (arrow down) to open the Advanced Panel and the next icon (arrow up) to close the current Imbalance GUI panel. The hot key 'Z' hides this panel, and hot key 'X' shows it again.

Advanced Panel has the options for the Normal Imbalance and Alternative Imbalance. Alt. Imbalance options are visible only when the Alt.Imbalance is active

Major Value is the minimum value of the larger Ask or Bid value in an Ask:Bid pair.

Ratio is a minimum Imbalance ratio of the Ask:Bid or Bid:Ask pairs to draw the Imbalance object.

Alternative Imbalance is the possibility to separate the high Ratio Imbalances from the Normal ones. The Alternative Imbalance Range is 1.5 - 30 and it is required that Alt.Ratio must be greater than Ratio of the Normal Imbalance because Alternative Imbalance always overwrites Normal Imbalance objects. Use checkbox to activate/deactivate Alt.Imbalance

Alt. Major Value is the minimum value of the larger Ask or Bid value in an Ask:Bid pair for Alt.Imbalance ratio

Alt. Ratio is a minimum Alternative Imbalance ratio that must be greater than Normal Imbalance Ratio.

CLUSTERDELTA IMBALANCE PARAMETERS DESCRIPTION

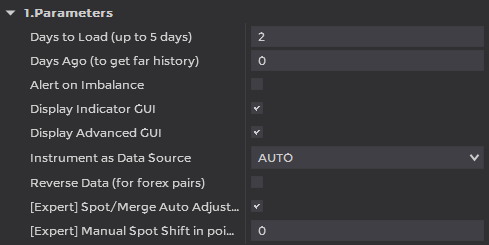

Parameters

Days To Load (up to 5 days) is the number of the days to load in history. To not overload server side do not use the big values. The "0" value uses the entire period that is loaded by NinjaTrader. Use the "Data Series" NT option (Ctrl+F) to change it.

Days Ago (to get far history) is the option to work with history data. It determines the number of days to skip from the current date and then load the required historical data using the "Days to Load" setting from the Common Settings.

Alert on Imbalance initiates the Alert event when the Imbalance just appeared on the current bar (see the "Options" section for alert animations).

Display Indicator GUI is a small graphical panel containing current access status (click to open the Authorizer), name of the indicator, Imbalance coefficients, the ticker name of the data source and the alert icon

Display Advanced GUI shows or hides the Advanced Panel on start

Instrument as Data Source - select a futures from the dropdown list as the source for data. Value AUTO causes automatic detection of the instrument using the NinjaTrader ticker.

Reverse Indicator Data is an option for reverse the indicators data (Ask ↔ Bid) for reversed currency pairs except those that have name "USDJPY", "USDCAD", "USDCHF", "USDMXN". This option was added for compatibility, but in 99.9% of NinjaTrader cases keep it turned off.

[Expert] Spot/Merge Auto Adjusting is an option that allows you to adjust Imbalance data to the spot chart using the latest highs and lows of the current trading session. The difference that is automatically calculated using this option may vary from trading session to trading session, so this may result in incorrect alignment of Imbalance data for different trading sessions.

[Expert] Manual Spot Shift in points sets the manual value to be used to adjust Imbalance data to the spot chart. Use the middle mouse button to measure the distance in points to use this value in this option.

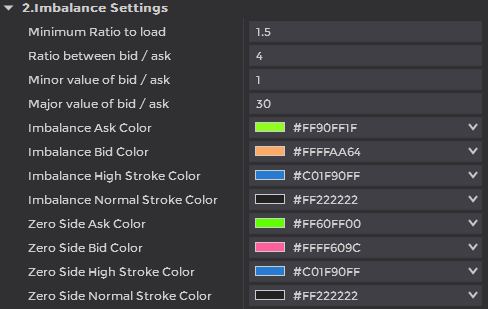

Imbalance Settings

Minimum Ratio to load is the minimum of the allowed Imbalance Ratio in the Imbalance Indicator dialog window

Ratio between bid / ask (Imbalance Ratio) is the minimum Ask:Bid or Bid:Ask ratio that must be reached to activate the Imbalance object on the chart.

Minor Value of bid / askis a required minimum value of the lower value in the Ask:Bid pair.

Major Value of bid / ask is a required minimum value of the larger value in the Ask:Bid pair.

Imbalance Ask Color is the color of the Imbalance object if Ask>Bid and Ask:Bid is equal to or greater than the Imbalance Ratio.

Imbalance Bid Color is the color of the Imbalance object if Bid>Ask and Bid:Ask is equal to or greater than the Imbalance Ratio.

Imbalance High Stroke Color is the additional border color around the Imbalance object with large amount of the volume.

Imbalance Normal Stroke Color is the border color around the Imbalance object.

Zero Side Ask Color is the color of the Imbalance object where Bid is zero.

Zero Side Bid Color is the color of the Imbalance object where Ask is zero.

Zero Side High Stroke Color is the additional border color around the Imbalance object with large amount of the volume.

Zero Side Normal Stroke Color is the border color around the Imbalance object.

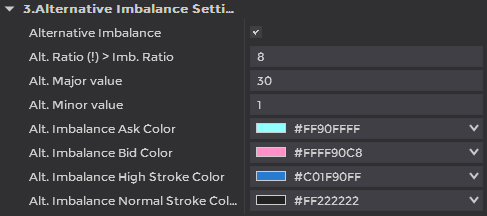

Alternative Imbalance Settings

Alternative Imbalance is an option to activate the Alternative Imbalance.

Alt.Ratio ((!) > Imb.Ratio) is the minimum Ask:Bid or Bid:Ask ratio that must be reached to activate the Alternative Imbalance object on the chart. The additional tip reminds that the Alt.Ratio must be greater than the normal Imbalance Ratio

Alt. Major Value is a required minimum value of the larger value in the Ask:Bid pair.

Alt. Minor Valueis a required minimum value of the lower value in the Ask:Bid pair.

Alt. Imbalance Ask Color is the color of the Alt. Imbalance object if Ask>Bid and Ask:Bid is equal to or greater than the Alt. Imbalance Ratio.

Alt. Imbalance Bid Color is the color of the Alt. Imbalance object if Bid>Ask and Bid:Ask is equal to or greater than the Alt. Imbalance Ratio.

Alt. Imbalance High Stroke Color is the additional border color around the Alt. Imbalance object with large amount of the volume.

Alt. Imbalance Normal Stroke Color is the border color around the Alt. Imbalance object.

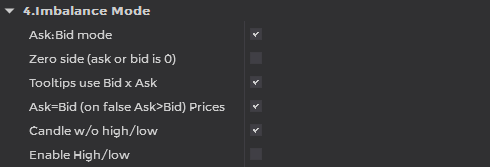

Imbalance Mode (common for both Imbalances)

Ask:Bid mode option turns on/off the mode "Ask:Bid" where both values are non zero and lower value of the Ask:Bid pair is greater than a minor size and largest value is greater than a major size.

Zero size option turns on/off the mode "Zero side" where one of the value is zero and another value is greater than a minor size.

Tooltips use Bid x Ask sets whether to use "Bid x Ask" or "Ask x Bid" mode for popup tooltips.

Ask=Bid (on false Ask>bid) (Calculate Mode) option switches the Imbalance between two modes "Ask=Bid" and "Ask>Bid". Ask=Bid modes means that Ask:Bid calculations use the same row values while "Ask>Bid" uses the Ask value 1 tick above the Bid value for calculations .

Candle w/o High/Low - an option that allows the indicator to use the entire bar without High/Low to calculate imbalances.

Enable High/Low is the option that allows the indicator to use the High/Low of the Bar to calculate Imbalances.

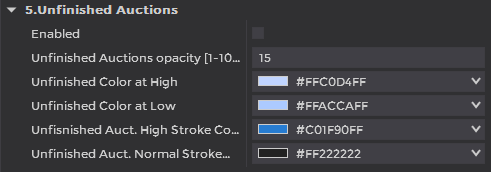

Unfinished Auctions

Enabled is the option that allows the indicator to calculate Unfinished Auctions. To use this option it is required to set Ask=Bid and Enable High/Low options to the "Yes" value

Unfinished Auctions opacity [1..100] is the transparency of the Unfinished Auctions objects

Unfinished Color at High is the color of the Unfinished Auction object at High price of the bar.

Unfinished Color at Low is the color of the Unfinished Auction object at High price of the bar.

Unfinished Auct. High Stroke Color is the additional border color around the Unfinished Auction object with large amount of the volume.

Unfinished Auct. Normal Stroke Color is the border color around the Unfinished Auction object.

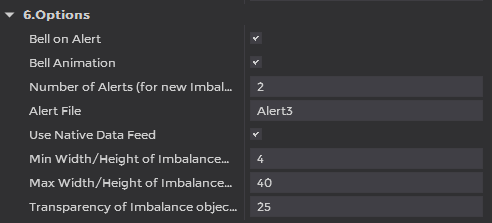

Options

Bell on Alert is the big Bell icon in the GUI panel when alert triggers.

Bell Animation is the few icons doing animation of the big Bell when alert triggers. It was a good idea at first, but it can get annoying during routine trading.

Number of alerts is an option for how many times to initiate a new imbalance alert event.

Alert File is an option for the sound file to be played when an alert event is triggered. The files located at the NinjaTrader_Install_Directory\Sounds directory

Use Native Data Feed is the option that allows to get tick data for updating Imbalances from the current feed if it is the futures feed.

Min Width/Height of Imbalance Objects is the value of the minimum width/weight for the Imbalance objects with lower volume values.

Min Width/Height of Imbalance Objects is the value of the maximum width/weight for the Imbalance objects with larger volume values that allows to scale the sizes of the rectangles by its volume values

Transparency of Imbalance Objects set the transparency to not cover the chart data.

Join us on ClusterDelta Discord channel and follow us in the Instagram: @clusterdeltatools