Indicator Name: ClusterDelta_#MarketProfile

The market (volume) profile shows the distribution of volumes on the prices over a certain period of time. The accumulations of volumes most often becomes support and resistance levels.

The #MarketProfile indicator allows you to build various types of profiles. In the middle of the 20th century, a technology was used in which the minimum unit for building a profile was a 30-minute candle. Modern technologies give us access to volumes in ticks, so we get the highest accuracy when constructing a profile. In the "modern" theory of volume trading, it is recommend to use volume profiles of the day (current and previous), week (current and previous), as well as the volume profile for the entire active contract.

At the time of building the volume profile, according to the market profile theory, Value Area (VA) is calculated, with its high and low prices (VAH/VAL) - the area in which 80% of the traded volume is located. When constructing a profile, we use modern knowledge in probability theory and statistics and use the first standard deviation (68.2%).

The #MarketProfile indicator has been improved for use with historical data. This indicator shows not only the Market Profile, there were added some more different layers of the data.

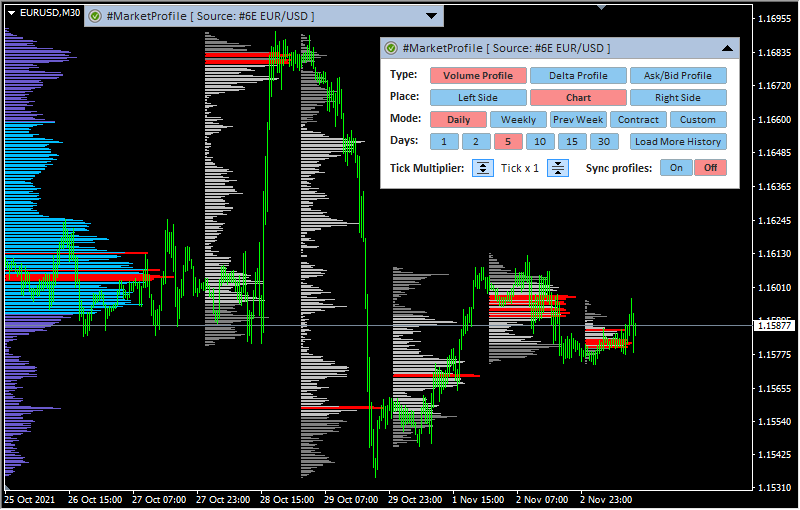

Description of graphic panel:

-

1 - authorization status (for more details on authorization, see the How to install and use indicators section)

- Volume Profile - the profiles will be built by volumes

- Delta Profile - the profiles will be built by delta

- Ask/Bid Profile - the indicator will build separate profiles for Ask and Bid volumes

- Left Side - the profile will be in the left side of the chart window

- Chart - the profiles will be built directly on the price chart

- Right - the profile will be in the right side of the chart window

- Daily - from the start of Globex trading until the break, 00:00-23:59 GMT+2 (the number of days can be changed using point #5)

- Weekly - from the start of Globex trading on Monday until break on Saturday. (the number of weeks can be changed using point #5) .

- Prev Week - the Prev Week period will be calculated as exclusively the entire previous week (the week is counted from Monday to Sunday)

- Contract - the Contract build period is the trading period of the entire futures contract

- Custom - two vertical lines will appear on the chart, which limit the period. They can be freely moved around the chart using the mouse

- HELP_URL - this is the URL where you can get the full description of the indicator.

- Profile Type - defines the type of profile to draw.

Possible values of the Profile_Type:

- AskBidProfile - the source of data for building the profiles is ASK and BID volumes that plot in different directions (may be changed).

- DeltaProfile - the source of data for building the profiles is Delta - the difference between ASK and BID volumes. The Delta profile is plotted as two profiles with a positive and negative delta in opposite directions (may be changed)

- VolumeProfile - the source of data is Volume (sum of Ask and Bid orders)

- Select Futures from List - select a futures from the dropdown list as the source for data. Value AUTO causes automatic detection of the instrument by the MT ticker.

- MetaTrader_GMT - the GMT value of your Metatrader. In 95% of cases leave AUTO.

- Profile Period - define time periods for building the profiles.

Possible values of Profile_Period:

- Custom_Period - custom mode, when indicator data uses the period from Custom_Start_time to Custom_End_time or for the period obtained from the vertical lines of the chart (depending on the value of Get_Custom_Period_from_Chart)

- per_Hour - the building period is a hour

- Daily - the building period is a day (from start trading after market break)

- Weekly - the building period is a week (from start trading after market break on Monday to start break on Saturday)

- Last Week - the building period will be calculated as the entire previous week (the week is counted from Monday to Sunday)

- per_Asia - the building period is 00:00 - 09:00 GMT+2

- per_Europe - the building period is 09:00 - 15:00 GMT+2

- per_NYSE - the building period is 15:00 - 24:00 GMT+2

- per_CME - the building period is 16:30 - 23:30 GMT+2

- per_Contract - the building period will be defined as the entire current contract since the last rollover

- Amount of Profiles - the number of profiles to build in a series for the period specified in "Profile Period" option

- Profile_Position - defines the position to show profiles (chart or static position in the current window).

Possible values Profile_Position:

- Draw_OnChart - the profiles will be built directly on the price chart.

- WindowLeft - the profile (one only) will be statically located on the left side of the chart window

- WindowRight - the profile (one only) will be statically located on the right side of the chart window

- Forex_auto_shift - if it's true, the indicator automatically determines the offset between futures and forex prices (basis).

- Forex_Shift - the number of points by which the indicator data will move up or down if the Forex_auto_shift parameter is set to "false". The value can be greater than or less than zero. It is intended to take into account the forward points (the difference between the price of the futures and the spot). It should be indicated as distance in the pips (according to the MetaTrader instrument specification).

- Lines Width - the lines thickness in the range of 1-5

- Comment_AskBidProfile - just a comment describing parameters below

- AskColor_AskBidProfile - line color in a profile of the AskBidProfile type for ASK volumes

- BidColor_AskBidProfile - line color in a profile of the AskBidProfile type for BID volumes

- Ask_Direction - direction of drawing lines of the AskBidProfile type for ASK Volumes

- Bid_Direction - direction of drawing lines of the AskBidProfile type for Bid Volumes

- Comment_DeltaProfile - just a comment describing parameters below

- DeltaPositive_AskBidProfile - line color in a profile of the DeltaProfile type for positive Delta values

- DeltaNegative_AskBidProfile - line color in a profile of the DeltaProfile type for negative Delta values

- DeltaPositive_Direction - direction of lines in a profile of the DeltaProfile type for positive Delta values

- DeltaNegative_Direction - direction of lines in a profile of the DeltaProfile type for positive Delta values

- Comment_VolumeProfile - just a comment describing parameters below

- VolumeLine_VolumeProfile_Color - color of the lines in a profile of the VolumeProfile type for values outside of the Value Area (68.2% of total volumes)

- VolumeLine_VolumeArea_Color - color of the lines in a profile of the VolumeProfile type for values that corresponds the Value Area (68.2% of total volumes)

- VolumeLine_Max_Volume - line color of the maximum volumes in the profile

- VolumeLine_MinorMax_Sync_Volume - line color of the maximum volumes in the local profile that is globally synced with others, and which max value is much lesser than a global maximum value

- VolumeLine_VolumeArea_Lines - line color of the VAH/VAL lines of the current profile

- Draw VAL/VAH Lines - indicates whether to draw or not VAL/VAH lines of the current profile

- Max_Volume_k - parameter defining maximum volumes as values that are not less than a certain part of the highest volume (A value of 0.85 means that volumes exceeding 85% of the highest volume will be marked as maximum by the color of VolumeLine_Max_Volume / VolumeLine_MinorMax_Sync_Volume depends on their side and sync option)

- Print_Max_Volume - option for printing/hiding the absolute value of the highest volume on the chart

- ReverseChart - for reverse currency pairs with names that differ from "USD/JPY", "USD/CAD", "USD/CHF", the value must be "true" to flip indicator data according to the direction of the price chart

- DO_NOT_SET_ReverseChart ("...for USD/JPY, USD/CAD, USD/CHF --") - just a comment

- Get_Custom_Period_from_Chart - with the Profile Period equal to the Custom_Period value, the indicator will get data for the Custom_Start_Time and Custom_End_Time fields directly from the vertical lines placed on the chart

- Custom_Start_time, Custom_End_time - if Custom_Start_Time and Custom_End_Time differ from their default values and Get_Custom_Period_from_Chart is false, Profile Period is Custom_Period, the server loads data for the period specified by these parameters

- Custom_Zoom - scaling of the drawing area to the actual area (i.e. up to 100%). The available range is 10-300. Used to change the width of the space in order to draw a profile that occupies less/more space on the chart. Option overwrites Zoom_Scale_in_percent value only if the Profile Period option in the Custom Profile mode

- Lines_are_Background - used for profile lines as MetaTrader objects property Background which means "plot as background".

- TickMultiplier - when constructing a profile with the merging of the nearest ticks, the number of which is defined by this setting - the volumes also are merged inside this group of ticks. In highly volatile markets, volumes are distributed in a wide range, which does not give a clear visual advantage of the levels. This setting allows you to better find areas

- Expert_User_Settings (value is "--------- Settings for expert users ---------") - just a text comment

- ZOOM_scale_in_percent - the value to scale profile size inside the area defined by time period that profile is built. The whole area defined by the time period is 100%. Value of Custom_Zoom overwrites this option if the "Profile Period" is "Custom Profile"

- Screen Size(%) (Left/Right) - the scaling value of the profile size inside the current chart window on the left or right side of the window. 100% is the width of window

- Sync_Profiles - when constructing a profile, the length of the profile lines corresponds to the ratio of the current volume to the maximum volume. When the setting is disabled, the synchronization of the lines length depends on the maximum volume in the current profile. When the setting is enabled, the synchronization of the lines length depends on the maximum volume that will be found by analyzing all values of all built profiles. In other words, the enabled setting allows you to visually see the interrelation of volumes in different periods when analyzing several profiles.

- MP_Area_Percent - the percentage of the Value Area to calculate VAL/VAH prices

- Show_Sum_Values - show/hide total number of volumes / delta / ask bid that were used in the entire profile (located under / above profile)

- GUI - flag indicating the need to draw a graphical user interface (control panel)

- GUI_Size_Scale - fractional multiplier to scale the size of the graphical control panel on the monitors with a high resolution

- GUI_Hint - usage of hot keys. Press 'Z' to hide / 'X' to show GUI

2 - the name of the indicator and the instrument - the data source. Using Drag & Drop, you can move the panel along the chart (to activate the panel, you may need to double-click the mouse)

3 - the icon to Expand/Collapse graphic panel

4 (Type) - indicator building mode corresponding to the Profile_Type input parameter.

6 (Mode) - the periods to build profiles corresponding to the Profile_Period input parameter.

8 (Tick Multiplier) - when constructing a profile with the merging of the nearest ticks, the number of which is defined by this setting - the volumes also are merged inside this group of ticks. In highly volatile markets, volumes are distributed in a wide range, which does not give a clear visual advantage of the levels. This setting allows you to better find areas of interest in such markets.

9 (Sync profiles) - when constructing a profile, the length of the profile lines corresponds to the ratio of the current volume to the maximum volume. When the setting is disabled, the synchronization of the lines length depends on the maximum volume in the current profile. When the setting is enabled, the synchronization of the lines length depends on the maximum volume that will be found by analyzing all values of all built profiles. In other words, the enabled setting allows you to visually see the interrelation of volumes in different periods when analyzing several profiles.

You can hide the panel completely from the screen with the "Z" button - pressing it again will return the panel display.

The F5 button allows you to reinitialize the coordinates of the panel based on the current size of the chart window (it helps if the panel has disappeared from the workspace). Please note that resetting coordinates will not display the panel that is already hidden by the Z button or by the input "GUI" parameter.

When adding an indicator to a chart, priority is given to the input parameters. However, after making changes to the settings through the graphic panel, the indicator takes the current parameters from the graphic panel when the timeframe changes. In some cases, removing and re-attaching an indicator will help to solve a specific problem.

Description of indicator inputs: